If we had a crystal ball, we would only loan money to someone if we knew they would pay us back. A lending institution can make use of predictive analytics to reduce the number of loans it offers to those borrowers most likely to default, increasing the profitability of its loan portfolio. This is commonly called credit risk scoring or loan default optimization.

The solution presented here uses simulated data for a small personal loan financial institution, containing the borrower’s financial history as well as information about the requested loan. A model is created to predict whether a borrower will default. This model is used to help decide whether or not to grant a loan for each borrower.

The Microsoft Loan Credit Risk solution is a combination of a Machine Learning prediction model and an interactive visualization tool, PowerBI. The solution is used to reduce the risk of borrowers defaulting on their loan and not being able to pay (part of) their loan to the lender.

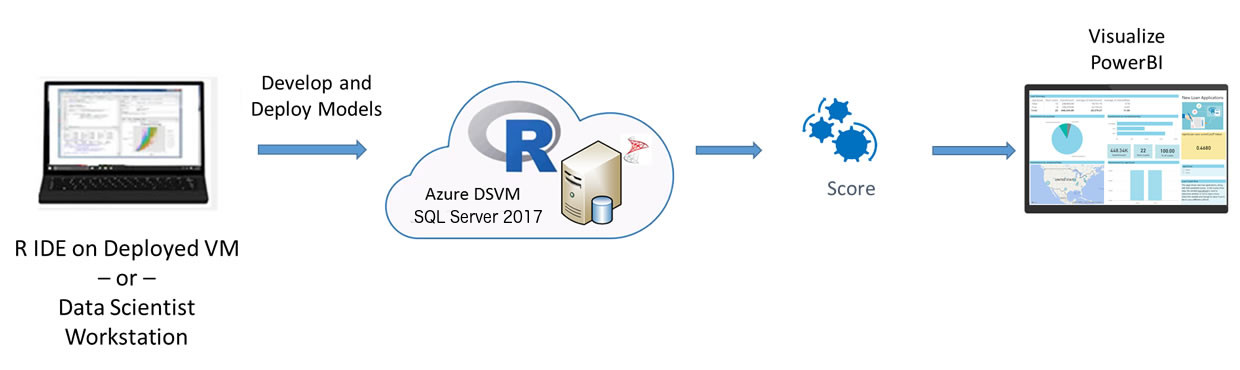

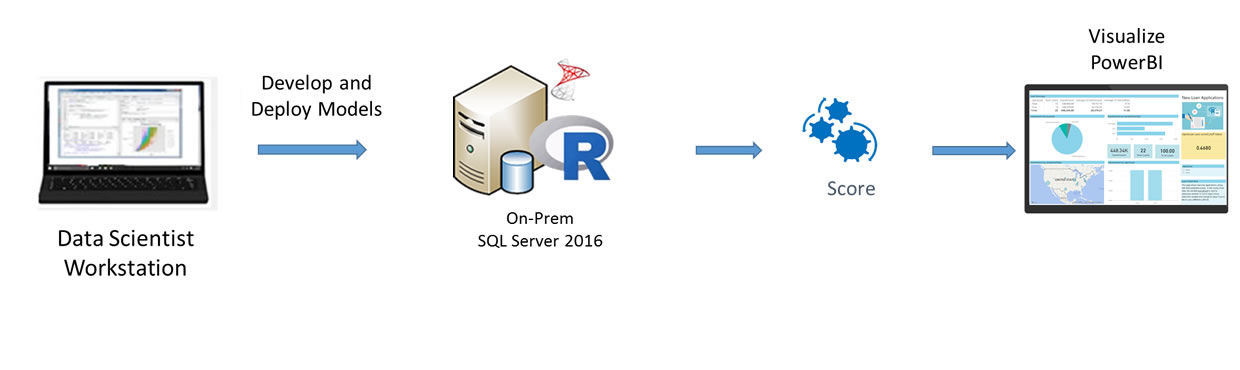

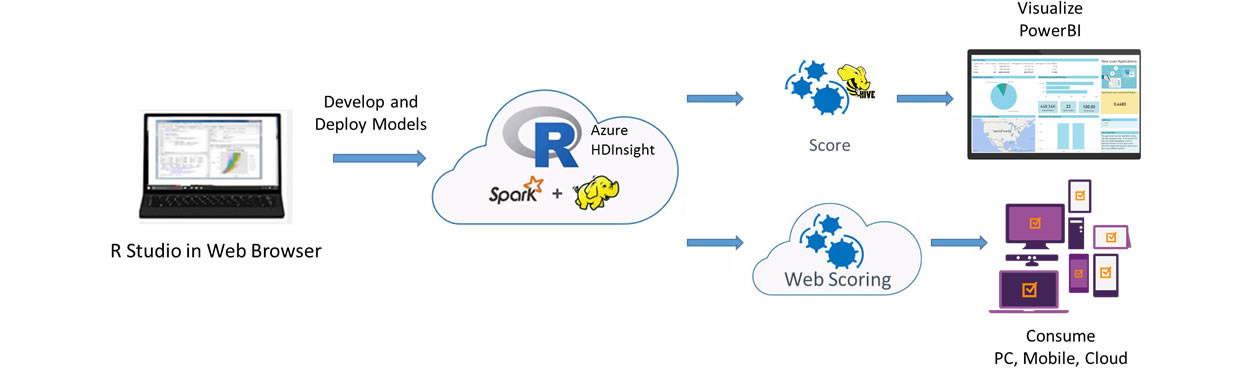

Select the method you wish to explore:

Loans contains all the data and results of the end-to-end modeling process.