A charged off loan is a loan that is declared by a creditor (usually a lending institution) that an amount of debt is unlikely to be collected, usually when the loan repayment is severely delinquent by the debtor. Given that high chargeoff has negative impact on lending institutions’ year end financials, lending institutions often monitor loan chargeoff risk very closely to prevent loans from getting charged-off. Using Azure HDInsight ML Server, a lending institution can leverage machine learning predictive analytics to predict the likelihood of loans getting charged off and run a report on the analytics result stored in HDFS and hive tables.

Select the platform you wish to explore:

LoanChargeOff_R contains all the data and results of the end-to-end modeling process.

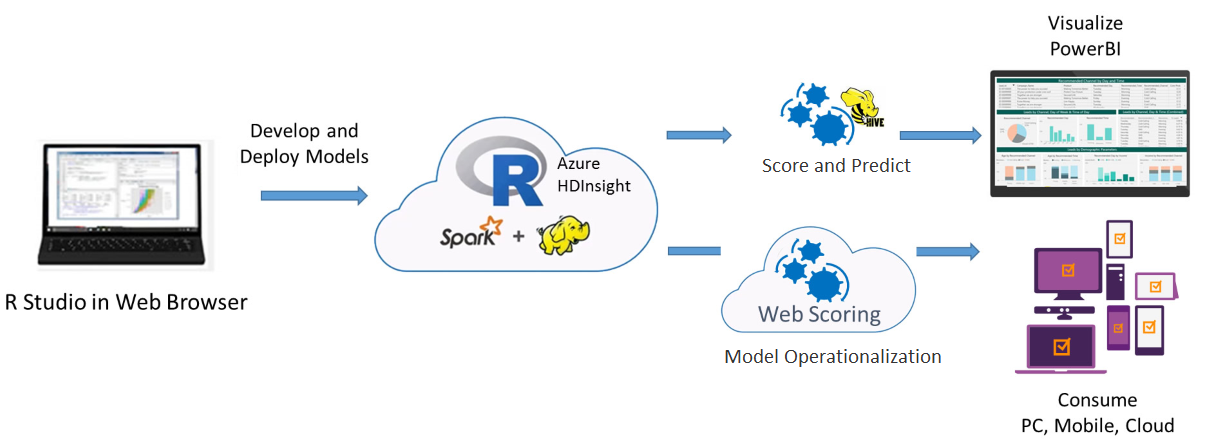

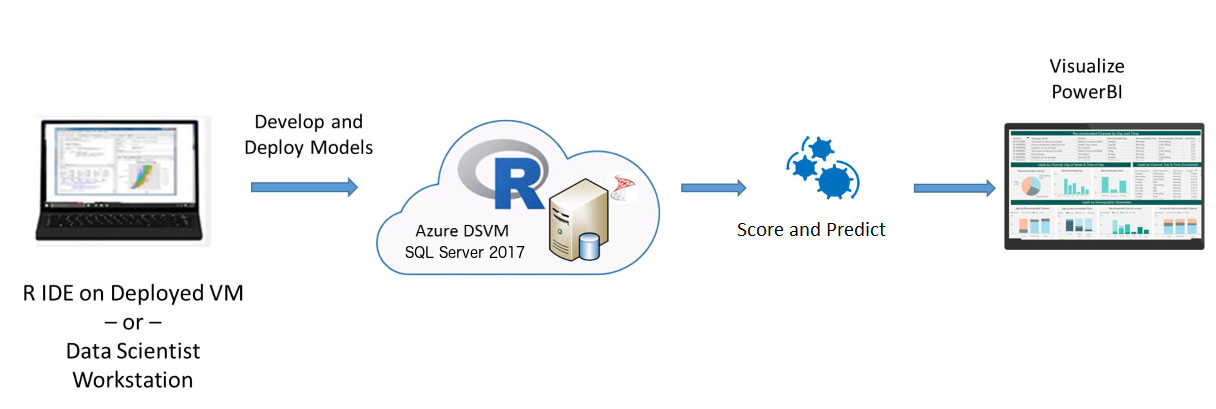

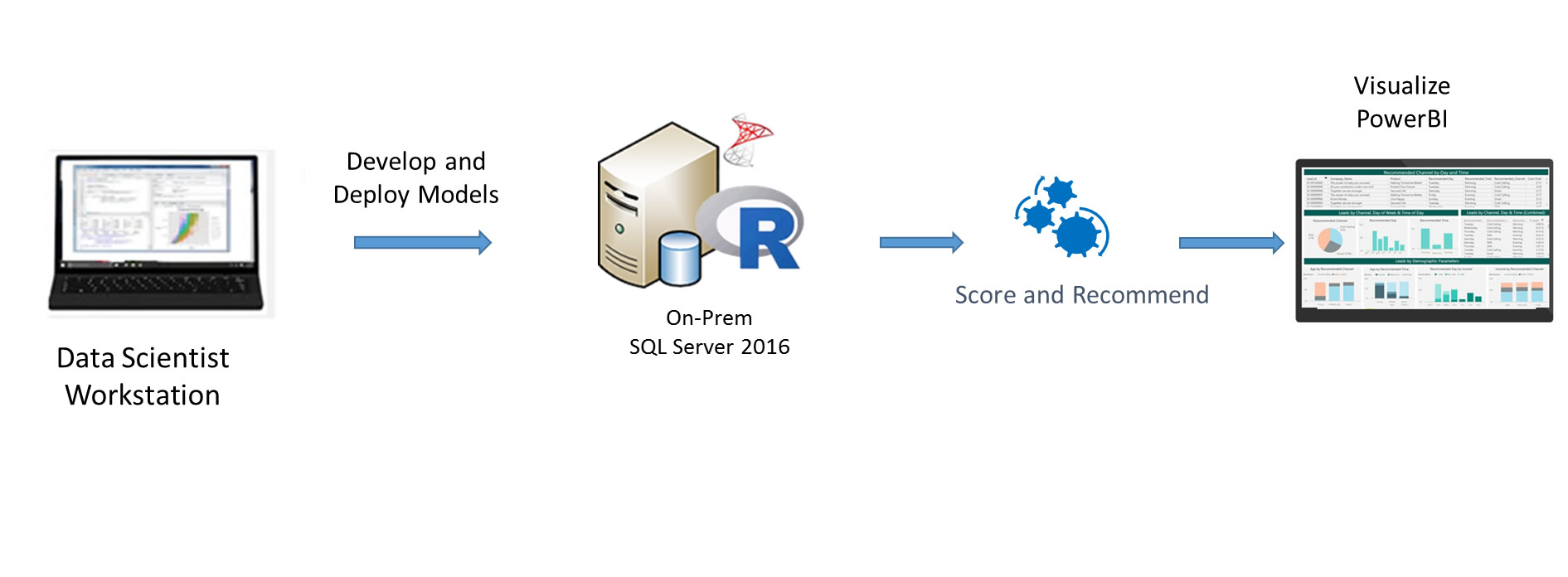

We have modeled the steps in the template after a realistic team collaboration on a data science process. Data scientists do the data preparation, model training, and evaluation from their favorite R IDE.using the Open Source Edition of RStudio Server on the cluster edge node. DBAs can take care of the deployment using SQL stored procedures with embedded R code. We show how each of these steps can be executed on a SQL Server client environment such as SQL Server Management Studio. Scoring is implemented with ML Server Operationalization. Finally, a Power BI report is used to visualize the deployed results.